When it comes to quarterlies, the devil is in the details. And for IndusInd Bank, Net Interest Income (NII) is one number that everyone waits with bated breath for. With the Q1 FY2025 results just around the corner, everyone’s eyes are on whether IndusInd Bank can maintain its robust momentum.

But what does the Q1 preview indicate so far? Will the bank post robust NII growth? Let’s dissect it all here in this elaborate analysis.

Why This Quarter Is Important for IndusInd Bank

Q1 generally establishes the tone for the financial year. For IndusInd Bank, which has seen significant transformation in the past few years, a robust Q1 could restore investor confidence—given today’s macro environment.

Focus Keyword: What is Net Interest Income (NII)?

Net Interest Income (NII) refers to the net difference between the interest received on loans and interest paid on deposits. It’s an important proxy for a bank’s core operating profitability. Greater NII typically reflects robust lending activity and effective asset-liability management.

IndusInd Bank: Background and Recent Performance

Overview of IndusInd Bank

IndusInd Bank is a top Indian private-sector lender, with a presence in both corporate and retail banking. It has over a million customers in urban and rural geographies and has been aggressively digitizing its business.

Q4 FY2024 Performance Highlights

In Q4 FY24, IndusInd Bank’s performance was as follows:

Revenue from operations of ₹5,376 crore, up 18% YoY

Net profit of ₹2,349 crore, up 15% YoY

Gross NPA ratio of 1.86%, better than last quarter

This provides a robust buffer while entering Q1 FY2025.

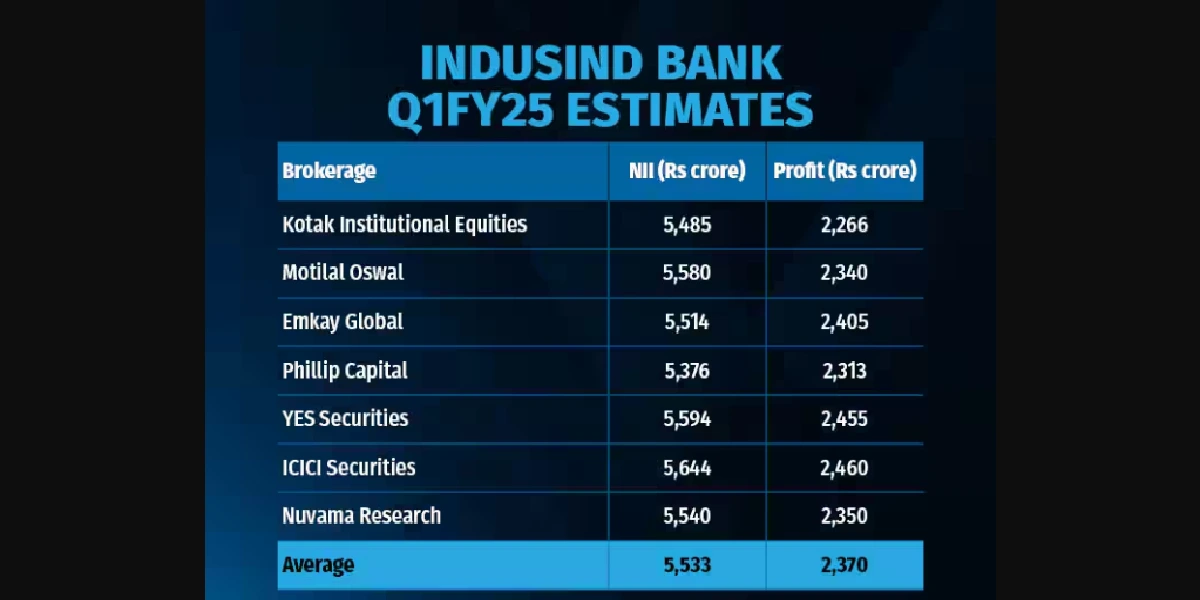

What Analysts Are Expecting for Q1 FY2025

Estimated NII Growth

Brokerage estimates indicate a 15-18% YoY growth in NII, driven by increased disbursals and firm margins.

Advances and Deposit Growth

18-20% YoY loan book growth is expected, primarily in the retail and auto finance books. Deposits are also expected to increase at a comparable rate.

Credit Quality Expectations

GNPA and NNPA ratios are likely to stay steady, with no high stress anticipated in retail loans. But SME and unsecured loan segments may reflect gentle pressure.

Operational Metrics Forecast

NIM (Net Interest Margin): Should be flat or slightly higher at ~4.2%

Cost-to-income ratio: Could see a slight improvement with efficiencies on account of technology

Deep Dive: Net Interest Income (NII) Forecast

Historical NII Performance

Q1 FY24: ₹4,867 crore

Q2 FY24: ₹5,020 crore

Q3 FY24: ₹5,228 crore

Q4 FY24: ₹5,376 crore

This trend shows steady growth, and analysts project Q1 FY25 to reach ₹5,600-5,700 crore.

NII Compared to Peers: HDFC, ICICI, Axis

While HDFC Bank takes the lead with NII at around ₹25,000 crore, IndusInd’s growth rate has been higher. ICICI Bank and Axis Bank also reported similar trends, but IndusInd’s specialty in vehicle finance provides it with an advantage.

Key Drivers of NII This Quarter

Growth in retail loans, particularly vehicle and microfinance

Cost of funds remaining stable

Digital onboarding driving cost of acquisition down

Other Key Metrics to Monitor

Net Profit Estimates

Analysts have estimated net profit at ₹2,400-2,600 crore, supported by robust operating income and well-managed provisioning.

Non-Interest Income Forecast

Fee income, treasury income, and forex gains may add a combined ₹1,800 crore or more, marginally better than Q4.

Asset Quality and GNPA/NNPA Trends

Expected to stay at:

GNPA: 1.8%–1.9%

NNPA: 0.6%–0.7%

Market Sentiment and Stock Outlook

Recent Stock Movement

IndusInd Bank’s shares have gained +5.6% in the past month, a testament to positive sentiment. Investors are hoping for better Q1 performance.

Broker Recommendations

Brokerages such as Motilal Oswal, Emkay, and ICICI Direct have assigned a ‘Buy’ with target prices in the range of ₹1,700–₹1,850.

Challenges That May Impact Q1 Performance

Interest Rate Environment

Though RBI has not altered the repo rate, high deposit rates could exert mild pressure on NIMs.

Regulatory Updates

Any RBI tightening or asset classification change may impact earnings in H2, but negligible impact is anticipated this quarter.

IndusInd’s FY2025 Strategy

Digital Initiatives

With continued investment in digital banking, IndusInd is targeting 30% digital loan disbursements growth this year.

Retail and Corporate Lending Emphasis

The bank is concentrating on building its retail lending book, especially vehicle finance, credit cards, and MSME segments.

Conclusion: Is IndusInd Bank Ready for a Good Q1?

All indications are positive for IndusInd Bank’s strong Q1 FY2025, particularly Net Interest Income. With a diversified loan book, better operating metrics, and good digital traction, the bank appears to be on track.

However, investors need to be careful about macro issues such as interest rate movements and pressure on asset quality in specific loan segments. Overall, IndusInd appears to be a consistent performer with growth potential.

Read also: Hexaware Technologies Q2 Results 2025