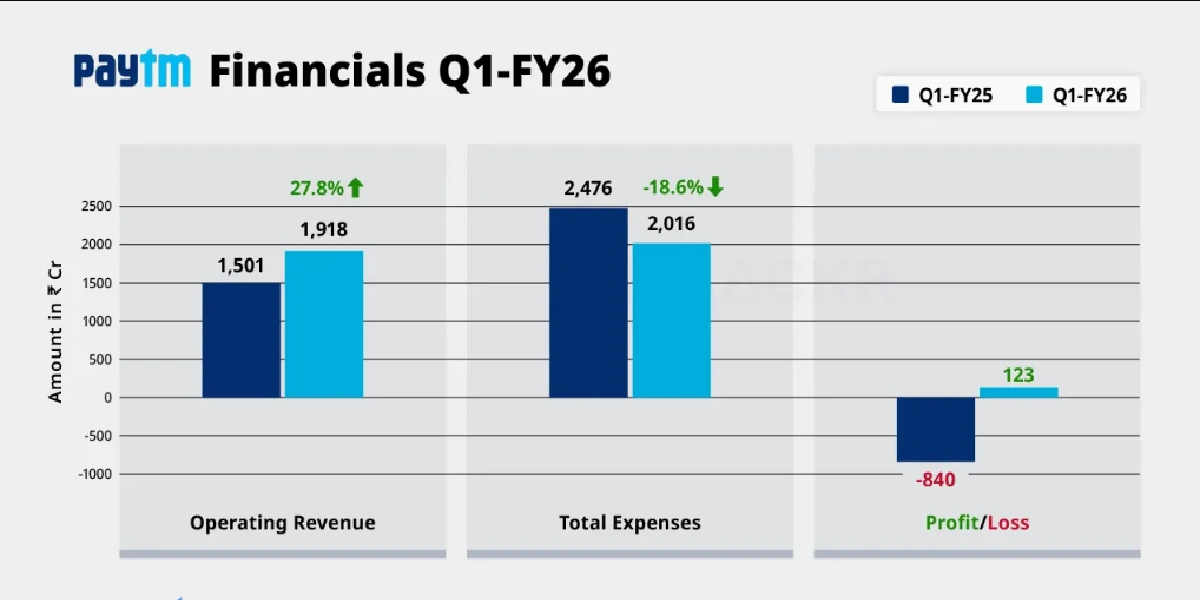

In a dramatic turnaround, Paytm’s parent company, One 97 Communications, swung from a crushing ₹839 cr loss in Q1 FY25 to a ₹122–123 cr net profit in Q1 FY26. This isn’t just a blip—it’s a strategic pivot grounded in revenue gains, tight cost control, and AI‑powered efficiency.

Background Context

Paytm’s Journey Since Listing

Since its IPO in November 2021, Paytm had struggled to deliver consistent profits. While there was a profit spike in September 2024, that was due to a one‑time ₹1,345 cr gain from selling its entertainment ticketing biz—not core business performance.

Challenges Prior to Q1 FY26

Regulatory setbacks, such as RBI’s action against Paytm Payments Bank, hurt liquidity and trust. Heavy ESOP charges in Q4 FY25 also weighed down profitability

Top‑Line Performance

Revenue Growth Overview

Paytm posted ₹1,918 cr in operating revenue—up 28% YoY from ₹1,502 cr Sequential growth was modest (~0.3%), signaling stability

Payments vs Lending Exposure

Payment revenue surged 38% YoY to ₹529 cr.

Financial services (mainly merchant lending) skyrocketed 100% YoY, contributing ₹561 cr

Bottom‑Line Breakthrough

Net Profit Details

The company logged a ₹122.5 cr net profit, reversing a ₹839 cr YoY loss

EBITDA Turnaround

EBITDA flipped positive at about ₹72 cr (4% margin), against previous quarters of heavy losses

Drivers Behind Turnaround

Surge in Financial Services Revenue

Merchant loans and trailing Default Loss Guarantee income powered a doubling of the fintech distribution segment

Cost Control & AI‑Led Efficiency

ESOP and Employee Costs

ESOP expenses dropped 88%, and overall employee cost fell 32%, thanks to voluntary forfeitures by founder Vijay Shekhar Sharma

Marketing Expense Reduction

Marketing spends were slashed ~55%, from ₹221 cr to ₹100 cr

Modern tools, including AI-based optimization, helped spur operating leverage

Increased Other Income

Ancillary gains added ₹241 cr to total income, raising it to ~₹2,159 cr

Balance Sheet Strength

Cash Reserves

Paytm is sitting on ₹12,872 cr in cash, providing ample flexibility for expansion

GMV and Merchant Growth

Gross Merchandise Value hit ₹5.4 lakh cr (≈$65 bn), up 27% YoY, with ~1.3 cr subscription merchants—evidence of platform resilience

Sustainability of Profitability

Risks & Regulatory Headwinds

Downside risks include tougher personal loan conditions, RBI’s oversight of banking operations, and macroeconomic variability

Growth Outlook in Lending & Payments

With signs of recovery in personal loans and continued merchant lending, Paytm expects revenue stream diversification to sustain momentum

Strategic Takeaways for Investors

What This Means for Share Price

Positive signals could continue, but valuations expect sustained execution. Continued cost control and lending growth will be key price drivers.

Positioning in Fintech Landscape

This quarter demonstrates Paytm evolving from a payments-first app to a scalable, profitability-first fintech platform.

What to Watch in Q2 FY26

Lending volume trends and margin quality

Cost discipline: ESOP vs employee pay mix

Regulatory updates around banking and UPI

Growth in personal vs merchant lending

Conclusion

Paytm’s Q1 FY26 profitability marks a turning point—shifting from structural losses to sustainable profits through diversified revenue, disciplined cost control, and cash strength. While regulatory and credit-cycle risks linger, the fintech heavyweight is proving it can balance growth and profits.

Read also: MCC NEET UG Counselling Registration 2025